“Technological progress has been one of the most potent forces in history in that it has provided society with what economists call a ‘free lunch,’ that is, an increase in output that is not commensurate with the increase in effort and cost necessary to bring it about.” Joel Mokyr, The Lever of Riches

INSIGHT

What’s the true value of Bitcoin?

Robert Hendershott and Don Watkins

Bitcoin is an example of what is possible in the 21st Century. The initial bitcoins were mined just 12 years ago; today, even though you can no longer pay for a Tesla in Bitcoin, they’re worth over $700b in aggregate.

A transformative innovation impacts progress generally, not just in its particular realm. This happens when the innovation significantly increases people’s ability to connect in new and important ways and/or provides a platform on which further insights and inventions are possible (or when it solves the problem of knowledge loss).

Examples include language, the scientific method, the transistor, and the Internet. Money also qualifies. By facilitating transactions, money connects people economically. Visible accurate prices provide feedback to support iterative learning. Money supports collaboration. Unlike stuff, it has a general, albeit intangible, value. A hammer is pretty much only good for hammering. Money can be used in an extremely wide variety of ways.

But money and finance have become increasingly regulated and controlled over time, stifling experimentation and the learning that comes from it. Centralized control has become paramount at the expense of innovation. FinTech has begun to chip away at this monolith, albeit mostly to sidestep cumbersome regulations. But this approach almost certainly will have a limited impact as authorities reliably crack down on innovations that go too far in their view. Witness the Chinese government re-establishing control over Alibaba’s Ant Financial.

Crypto, on the other hand, could demolish centralized authority over money.

Bitcoin opened a door that most assumed had been sealed shut forever, and many in power prefer to be kept shut. Before Bitcoin, it was assumed that digitalization would increase central control over money (and reduce privacy). That presumption has been shaken. Now the Fed is talking about issuing a cryptocurrency in an attempt to keep up.

Money connects buyers and sellers; it connects investors and entrepreneurs; and it connects entrepreneurial teams. Though there remain major barriers to cryptocurrency becoming a widely-used medium of exchange, they have the potential to span and meld all three of these dimensions of money to harness the ingenuity, enthusiasm, and passion of millions in ways that we are only starting to glimpse.

The real value of Bitcoin is beyond Bitcoin itself; it is the explosion of crypto experimentation that Bitcoin unleashed with the potential to change money and finance forever. Bitcoin is like Netscape: successful in its own right but even more important as a harbinger of things to come.

QUICK TAKES

The continuing miracle of the 21st century

We’ve noted how today’s leading tech companies have created unprecedented value with unprecedented rapidity. One question is whether that trend will continue.

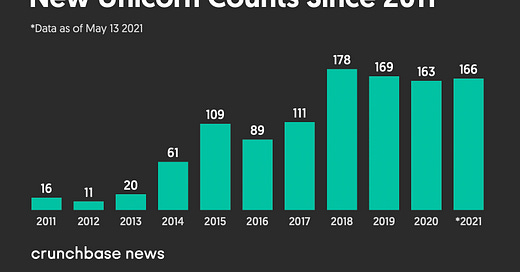

Here’s some evidence that it will. According to Crunchbase, the number of new unicorns (companies valued at $1 billion or more) has increased dramatically since the early 2010s.

It’s interesting to observe where the new generation of unicorns are coming from:

The fastest companies to become unicorns in 2021 were Chinese semiconductor company Moore Threads, Germany-based delivery company Gorillas, audio app Clubhouse, and proptech company Pacaso, both based in San Francisco, as well as Israel-based cybersecurity firm Wiz.

The three leading sectors for these new unicorns are financial services, health care, and privacy and security.

Peter Thiel is known for saying we’ve seen a lot of innovation in the world of bits but not the world of atoms. But it’s looking increasingly like the world of bits is starting to transform the world of atoms.

In a connected world, we can expect unicorns to appear in more and more aspects of life and regions of our planet.

Get your ass to Mars

Invention, we’ve noted, is only part of innovation. It’s one thing to develop a new capability—it’s another thing to make that capability cost-effective. Robert Zubrin argues that SpaceX’s uniqueness is in its relentless focus since Day 1 on making space travel affordable. Speaking of NASA’s Space Shuttle program, he observes:

The Shuttle’s average flight rate of four per year, meant that, with a program annual cost of $4 billion per year, the actual cost of a Shuttle flight was a whopping $1 billion.

What is SpaceX aiming for?

A [SpaceX] Starship transorbital railroad, employing 5,000 people, would cost about that much per year. [Elon] Musk is aiming to manage 200 flights, which is possible with 20 operational Starships each turned around to fly again every 36 days. That would work out to $5 million per flight, 1/200th the cost of the Shuttle with five times its payload, for a thousandfold improvement overall.

Some space cynics have suggested that all of this is a waste, and our focus should be on solving more pressing problems here on earth. But Zubrin makes a point I have not seen others make: the primary value—at least in the near-term—of opening up space is not colonizing Mars. It’s the vast amount of potential knowledge more cost-effective space exploration will open up. For example, he writes:

Starship won’t just give us the ability to send human explorers to Mars, the moon, and other destinations in the inner solar system, it offers us a two-order-of-magnitude increase in overall operational capability to do pretty much anything we want to do in space. That includes not only supporting a muscular program of probes to the outer solar system, and making all sorts of experimental investigations in Earth orbit economical, but enabling the construction of giant space telescopes. Much of our knowledge of physics has come from astronomy. This is so because the universe is the biggest and best lab there is. There is no better place to do astronomy than space. The 2.4-meter Hubble Space Telescope has made extraordinary discoveries. What might we learn once we are able to build 2.4-kilometer telescopes in deep space? The possibilities are literally inconceivable.

By the way, did you know that the Obama administration denied a petition to build a Death Star? Apparently, it balked at spending $85 quadrillion to build something “with a fundamental flaw that can be exploited by a one-man starship.”

Though I’m sure Elon could reduce the price by 99.5%, he’d probably have to blow up a dozen Death Stars in the process to discover what really works.

I can’t wait to play solitaire on this thing

Google plans to build a quantum computer by 2029.

A commercial-grade quantum computer doesn’t yet exist, but eventually it could solve some problems many millions of times faster than a conventional computer. . . .

By harnessing quantum physics, this type of computing has the potential to sort through vast numbers of possibilities in nearly real time and come up with a probable solution. Traditional computers store information as either zeros or ones. Quantum computers use quantum bits, or qubits, which represent and store information in a quantum state that is a complex mix of zero and one.

Expect to see breakthroughs in areas ranging from physics to chemistry to pharmaceuticals to financial modeling. According to Hewlett Packard Enterprise senior VP Mark Potter, quantum computing “holds the promise of being able to take on problems that could take a normal computer billions of years to solve and do it in seconds.”

Physical connection still matters

James Pethokoukis cites a recent paper arguing that “migrants to the U.S. are up to six times more productive than migrants to other countries.” In short, more immigration to the U.S. could accelerate progress. Pethokoukis adds:

The whole world benefits from smart people coming to America. How can we get more of them? The researchers highlight two approaches: easing financial constraints through scholarships and increasing the number of visas offered for permanent work-based immigration.

One thing this highlights is that physical connection still matters—particularly in a world where the environment for ingenuity can vary enormously from country to country.

And you think it’s annoying your doctor’s office is 20 minutes away

One of the biggest barriers to providing medical care in the developing world is transportation. It takes time (and money) to reach remote regions. Zipline is solving that problem with an army of drones capable of delivering supplies by parachute.

The [Cross River State] region will be the first within the southern part of South-South Nigeria to use drones in this way. There will be two distribution centres capable of reaching some 1,000 health facilities serving millions of people. The accuracy of the drops is the equivalent of two parking spaces.

Now just think about that for a second. Scores of requests coming in to those facilities every day, many involving life-threatening situations. If dispatched by ground, some of these journeys could take many hours – even more in muddy or other unfavourable conditions. A Zipline drone, by contrast, can often reach its destination within 30 minutes.

In somewhat less exciting news, Manna has created a drone delivery service to airdrop broccoli in Ireland.

RECOMMENDATIONS

Zero to One by Peter Thiel with Blake Masters

Here’s the challenge. Progress depends on creating things that are new—and no one can teach us how to create something new. But Peter Thiel’s Zero to One comes closer to teaching that than any book I’m aware of.

[T]his book offers no formula for success. The paradox of teaching entrepreneurship is that such a formula necessarily cannot exist; because every innovation is new and unique, no authority can prescribe in concrete terms how to be innovative.

What can be taught is a certain way of thinking: “the questions you must ask and answer to succeed in the business of doing new things.” Some of Thiel’s questions have become famous, such as “What important truth do very few people agree with you on?”

Innovators are contrarians. They “find value in unexpected places, and they do this by thinking about business from first principles instead of formulas.”

Thiel shares his first principles, including “It is better to risk boldness than triviality,” “A bad plan is better than no plan,” “Competitive markets destroy profits,” and “Sales matters just as much as the product.”

In perhaps the most interesting chapter, “You Are Not a Lottery Ticket,” Thiel takes aim at the notion that success is a matter of luck. “If you believe your life is mainly a matter of chance, why read this book? Learning about startups is worthless if you’re just reading stories about people who won the lottery.”

In Thiel’s view, we should cultivate what he calls “definite optimism.” Whereas the indefinite optimist believes “the future will be better,” he “doesn’t know how exactly, so he won’t make any specific plans. He expects to profit from the future but sees no reason to design it concretely.” This is the attitude that assumes someone will solve our problems…but it won’t be me.

“To a definite optimist,” by contrast, “the future will be better than the present if he plans and works to make it better.” But this requires a deep conviction that luck isn’t decisive in life—that you can make things better.

What emerges is the advice to think different. To challenge conventional wisdom, to discover secrets about how the world works and how people work, and actively build a better future. That, at the level of the individual, is what ingenuity looks like.

Until next time,

Don Watkins

P.S. Want to support our efforts? Forward this email to a friend and encourage them to sign up at ingenuism.com.

I really enjoyed this article. Thanks for writing it!